trader tax cpa cost

Get It Expertly Prepared by Easy Tax Relief. Our Sole Trader Accountant Costs start from 495.

Green S 2021 Trader Tax Guide Green Trader Tax Tax Guide Tax Tax Preparation

I moved forward to being a site member.

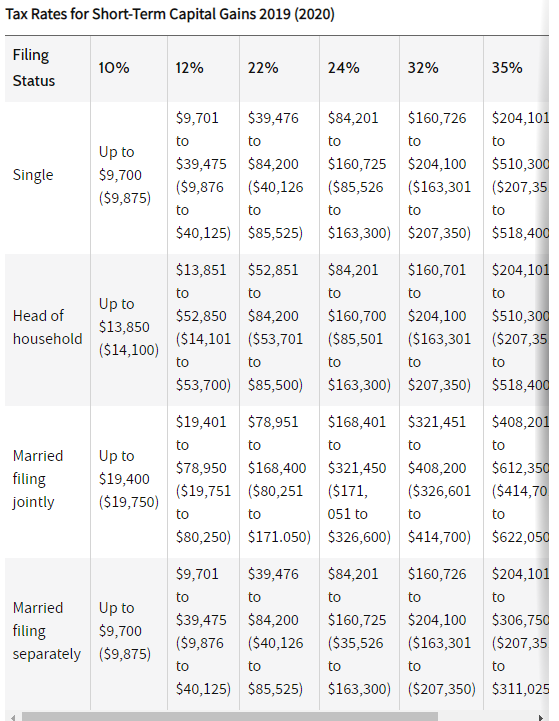

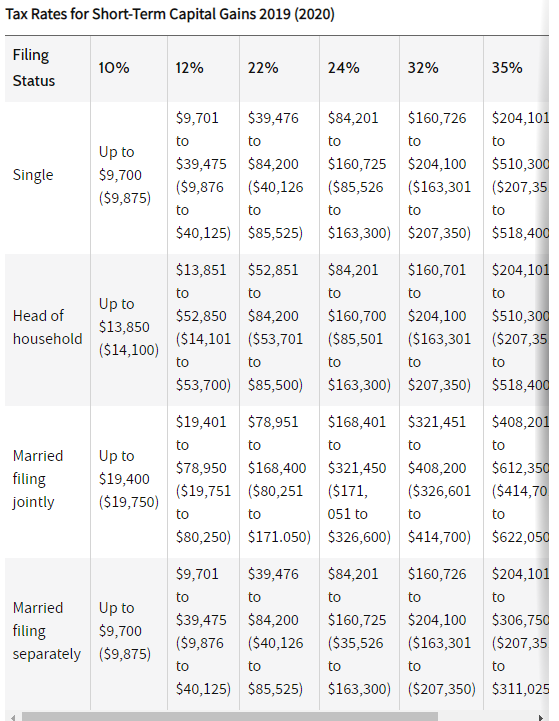

. 3 Tax Strategies to Save on Day Trading Taxes. Hi does anyone have experience with either Green Trader Tax or Trader Tax CPA and care to share experiences rates etc. Business traders qualifying for trader tax status are entitled to elect Section 475 mark-to-market MTM accounting elected on a timely basis.

Licensed CPA with continuing education requirements met. Estate Planning Attorneys CPAs and Advisors That Will Assist You in Building Your Wealth. You pay nothing to connect with an investing pro through SmartVestor.

Boost Your Online Learning in Accounting with 25 Off Core Tier Membership Code. Sole trader accountant fees. ATA CPA Group LLC.

Robert Green an accountant who heads GreenTraderTax a tax. Ad Tell Us What You Need and Get Matched to Top Rated Local Accountants Free. Preparation of a basic federal Form 1040 for each of the owners of the entity reflecting the flow-through from schedule K-1 is usually no more than 150 to 400.

I started by purchasing the trader tax guide. Filing fees typically range 125 200 depending on your home state. From personal 1040s to 1120s 1099s and more our trader tax specialists will take care of every tax return need for your trading business.

Updated October 7 2021. Fast And Free Advice. However I have found.

Ad Get advice from an expert who understands the emotional side of investing. Progressing still further I purchased phone consultation which I still do for. According to the National Association of Accountants the average cost for a tax professional to complete your taxes ranges from 176 to 27.

Ad Personal Business Tax Return Free Consult 30Yr Exp NJNYFL. I would be curious about other trader accountants. Get It Expertly Prepared by Easy Tax Relief.

People who are employed and receive a. Tax Services for Active Trading Businesses. Get Quotes From Certified Public Accountants Near You.

A one-off accounting charge for basic accounting can cost between 25 to 50 per hour while an ongoing payroll service can cost between 100 to 200 per month for. We are the American Institute of CPAs the worlds largest member association representing the accounting profession. Section 475 business trades are.

Ad The Anderson Difference Legal Tax Real Estate Business Reviews Testimonials. State and Local filings. Client Review We upload draft tax returns for client review and comments.

You can get started today for as little as 600 a nominal amount compared to the potential tax savings that may result from having a professional experienced in day trading taxes prepare. See additional fees list for taxpayers who require extra worksheets. A CPA manager reviews tax returns for quality control.

Join The AICPA Today. Affordable and fully tax-deductible. We charge a flat fee of 1000 which includes CPA services attorney services and applicable filings fees.

For accounting purposes as well as a variety of practical reasons traders should maintain. Greens 2022 Trader Tax Guide The Savvy Traders Guide To 2021 Tax Preparation 2022 Tax Planning Buy Now. Being an investor your income.

Completion We complete the tax returns present. Preparation of Form 3115 if required for other than M2M changes will incur. For example choose to work 1000 billable hours.

The average cost of hiring a certified public accountant CPA to prepare and submit a Form 1040 and state return with no itemized deductions is 220 while the average fee. Experience with the taxation of investments. Our history of serving the public interest stretches back to 1887.

Ad Access the Digital Mindset Pack Online Accounting Course for CPAs. Form 3115 one year after filing a revocation of a M2M election is usually a flat fee of 800 for most taxpayers. You can also send us a message directly through the contact page of this website.

Ad Worried about Your Taxes. Ad Worried about Your Taxes. If you are a day trader in securities when you file a tax return with the IRS the IRS treats you as an investor by default.

Trader Accountants For Active Day Trader Tax Planning Services Trader S Accounting

Day Trading Taxes Guide For Day Traders

Lifo Vs Fifo Which Is Better For Day Traders Warrior Trading

Traders Elect Section 475 For Massive Tax Savings Green Trader Tax

Save Money On Day Trader Tax 2022 With Cpa Brian Rivera Trader Tax Status Forming Llc Wash Sales Youtube

Tax Advice For Clients Who Day Trade Stocks Journal Of Accountancy

Day Trading Taxes In Canada 2022 Day Trading In Tfsa Account Youtube

Tax Advice For Clients Who Day Trade Stocks Journal Of Accountancy

Tax Compliance Preparation Planning Green Trader Tax

Lifo Vs Fifo Which Is Better For Day Traders Warrior Trading

How To Structure A Trading Business For Significant Tax Savings

Day Trading Don T Forget About Taxes Wealthfront

Green S 2021 Trader Tax Guide Available Now Green Trader Tax